Adaptive reuse is transforming NYC’s commercial vacant offices and industrial spaces into high-demand housing and mixed-use assets, creating rare opportunities for investors in Brooklyn, Manhattan, and Queens.

The Shift Every NYC Investor Should Be Watching

New York City’s real estate market is undergoing a quiet revolution. With office vacancies hovering around 20% citywide and housing demand showing no signs of cooling, adaptive reuse, the conversion of outdated commercial buildings into residential or mixed-use properties—is emerging as the next big investment trend for 2026 and beyond.

For investors, this shift represents a once-in-a-cycle opportunity. Manhattan’s Class B office buildings, Brooklyn’s industrial lofts, and underutilized spaces in Queens are being reimagined as vibrant apartment communities, boutique hotels, and co-living environments. According to the New York City Comptroller’s 2025 report, “Office-to-Residential Conversions in NYC: Economics and Fiscal Estimates,” developers are ramping up conversion plans in high-vacancy corridors such as Downtown Brooklyn, Long Island City, and Midtown Manhattan, signaling a major shift toward adaptive reuse investment opportunities across the city.

Why It Matters for Investors

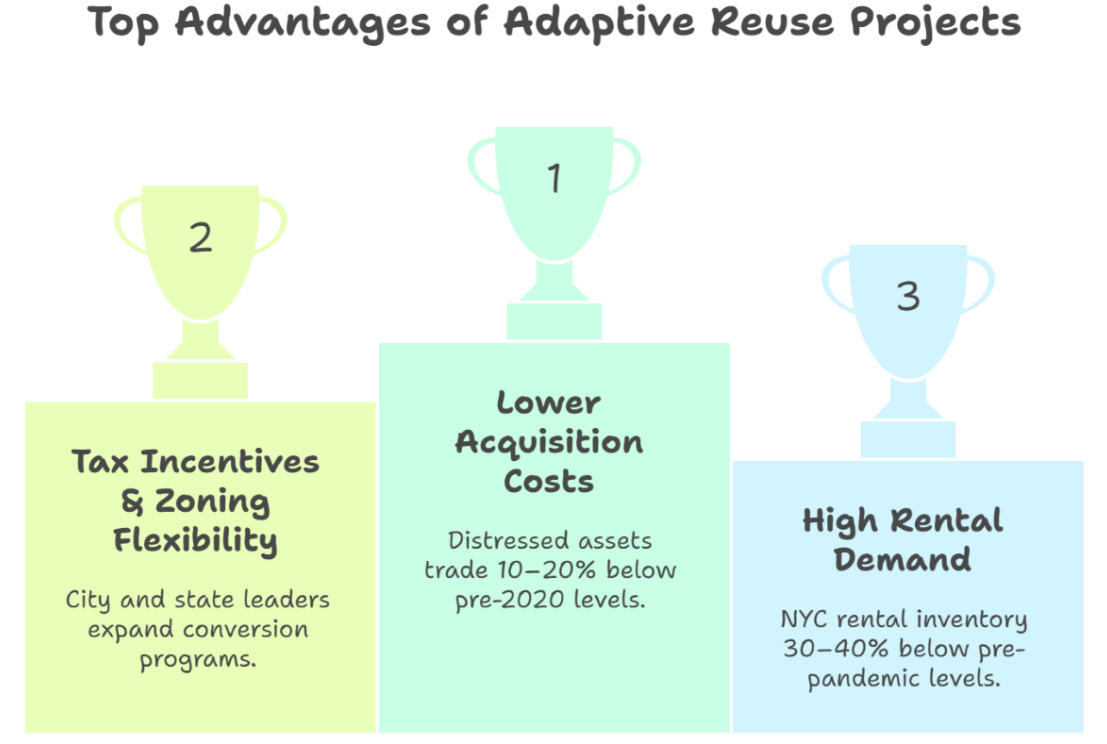

Adaptive reuse projects offer several key advantages:

-

Lower acquisition costs: Many distressed or underperforming assets are trading 10–20% below pre-2020 levels.

-

Tax incentives and zoning flexibility: City and state leaders are expanding programs to fast-track conversions, especially under the new City of Yes for Housing Opportunity zoning proposal.

-

High rental demand: NYC’s rental inventory remains 30–40% below pre-pandemic levels, with rent growth strongest in converted, character-rich buildings.

Unlike ground-up development projects, adaptive reuse allows investors to capture shorter timelines, lower carrying costs, and have a faster path into income-producing status.

A group of investors who are currently taking advantage of this real estate opportunity is Donahue Douglas, made up of developer Don Peebles and former BlackRock executive Doug McNeely. The partners have created an office conversion fund with plans to raise $1.5 billion. Right now, they are nearing $1 billion in commitments that include contributions from state pension plans, university endowments to institutional investors. The fund will target both underused and distressed buildings to create up to 15,000 housing units across cities including Washington D.C. , Los Angeles, Boston and San Francisco.

Ready to explore adaptive reuse opportunities across Brooklyn, Manhattan, or Queens? Let’s discuss active listings, recent conversions, and off-market assets positioned for high investor returns. Contact Ryan Roberts – Licensed Real Estate Salesperson – Douglas Elliman Real Estate